Scaling up manufacturing and improving productivity is seen as the opportunity for growth and job creation. Integrating Artificial Intelligence AI in manufacturing is expected to boost manufacturing and to take the United States into the path of becoming a manufacturing powerhouse. While there is much discussion and excitement going around AI there is another sector which is absolutely critical for the growth of the manufacturing industry. In this blog, I discuss this sector and its role in supporting manufacturing growth and sustainability.

Bringing back Manufacturing inside the borders is envisioned as the path to glory, economic growth and job creation. Artificial Intelligence is strategized as a way to automate, scale up and increase productivity in manufacturing. Though it is an innovative way to boost productivity and sustainability for the long term, what is imperative and urgent for growing manufacturing is a supporting environment and infrastructure for inventory management, supply chain and logistics. There is nothing more critical than having the raw materials and ingredients at the right time and at the right conditions for production.

Just-in-time inventory is the ideal and ultimate milestone for inventory management. However, a practical and realistic scenario is to have inventory ahead of a certain time period for uninterrupted production though it need not be too far ahead of time. Having inventory much ahead of time at the production facility incurs additional capital expenditure and overhead costs in storage, utilities, energy bills, materials handling and management. On the other hand, not having inventory on-time causes production delays. Apart from inventory, Production delays happen for many other reasons too including shortage of workforce, weather conditions, transportation issues, machine malfunction, natural calamities, budget constraints, policies, regulations, etc..

Among the above reasons for production delays, two of those that can be managed and strategized with meticulous planning are on-time inventory and skilful workforce. Having the raw materials that meet the quality criteria and workforce at the right place at the right time avoids production delays and increases productivity.

An approach to have inventory on-time with lesser capital expenditure and overhead cost is by having them in short-term, built-to–suit warehouses at locations near the manufacturing facilities or in a transitory location that is cost-effective and having good transportation facilities. Leasing or renting warehouses that can store materials with proper storage and packaging parameters will help in having the materials on time and in the right conditions appropriate for manufacturing on time and without delays. Further Warehouses are shared space resources and hence can lower storage costs and ultimately production costs. Warehouses are typically constructed in cost-effective locations with lower land values. They are constructed with the objective to optimize cost, storage space, energy usage and at the same time provide robust infrastructure for materials handling and management.

Warehouses and Manufacturing

Warehouses have supported the growth of retail businesses and e-commerce platforms. They are built with proximity to retail businesses as storage centers or as distribution centers. The items ordered online by customers are dispatched from the distribution centers typically leased by big retailers. Similarly online orders received in e-commerce platforms are delivered from storage centers and fulfillment centers leased/rented by such platforms. Further e-commerce platforms also lease or rent warehouse spaces near urban and populated regions to achieve quicker last mile on-time delivery.

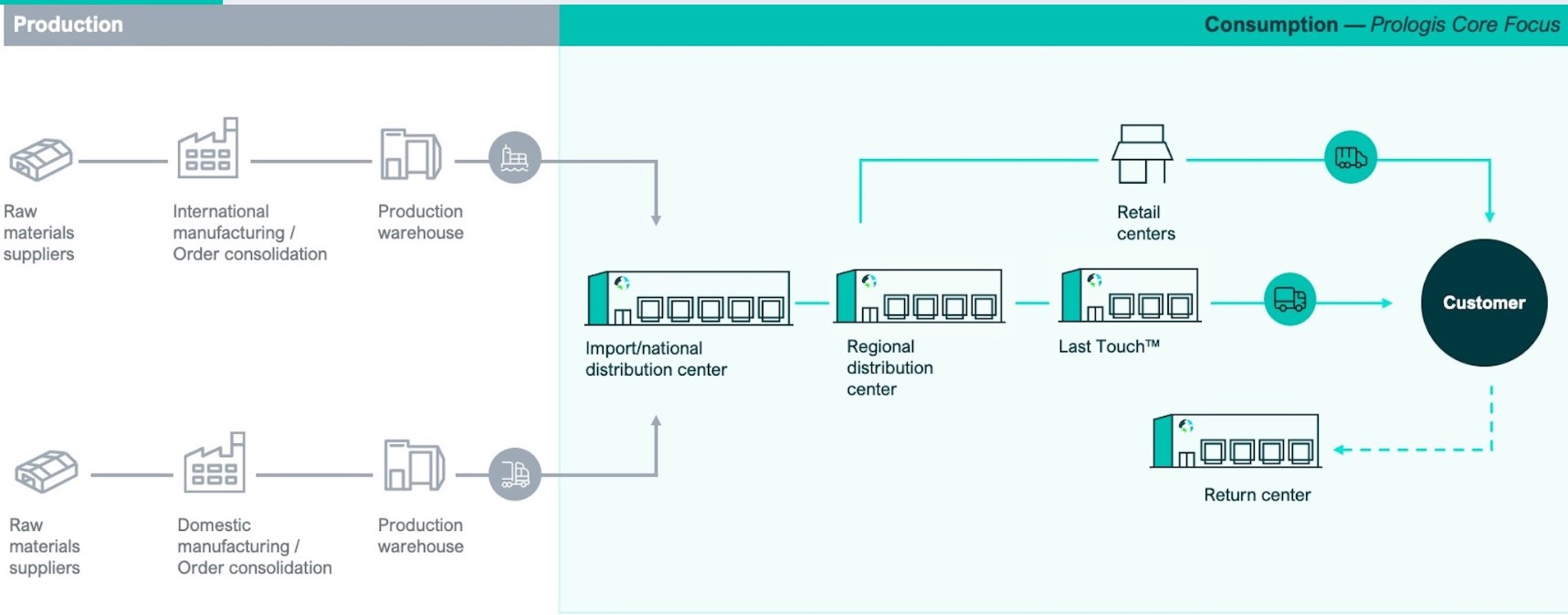

Warehouses for retailers and manufacturers are at different locations based on their respective objectives. Warehouses for retailers and e-commerce platforms are built where consumption of goods happens whereas Warehouses for manufacturers are built where production of goods happens. These warehouses called Production warehouses are at locations that are optimized to be closer to both the sources of raw materials and manufacturing centers.

The growth in the E-Commerce industry spurred the necessity of constructing warehouses at vantage locations for retailers and e-commerce platforms to remain competitive and to increase revenue. On the same line of thought, growth in manufacturing should propel the need for more production warehouses. Vice-versa, the presence of production warehouses near manufacturing centers should benefit manufacturers by providing cost-effective storage and timely predictable deliveries of inventories.

The following diagram from a paper published by Prologis1 helps to visualize warehouses based on the location in which it is situated.

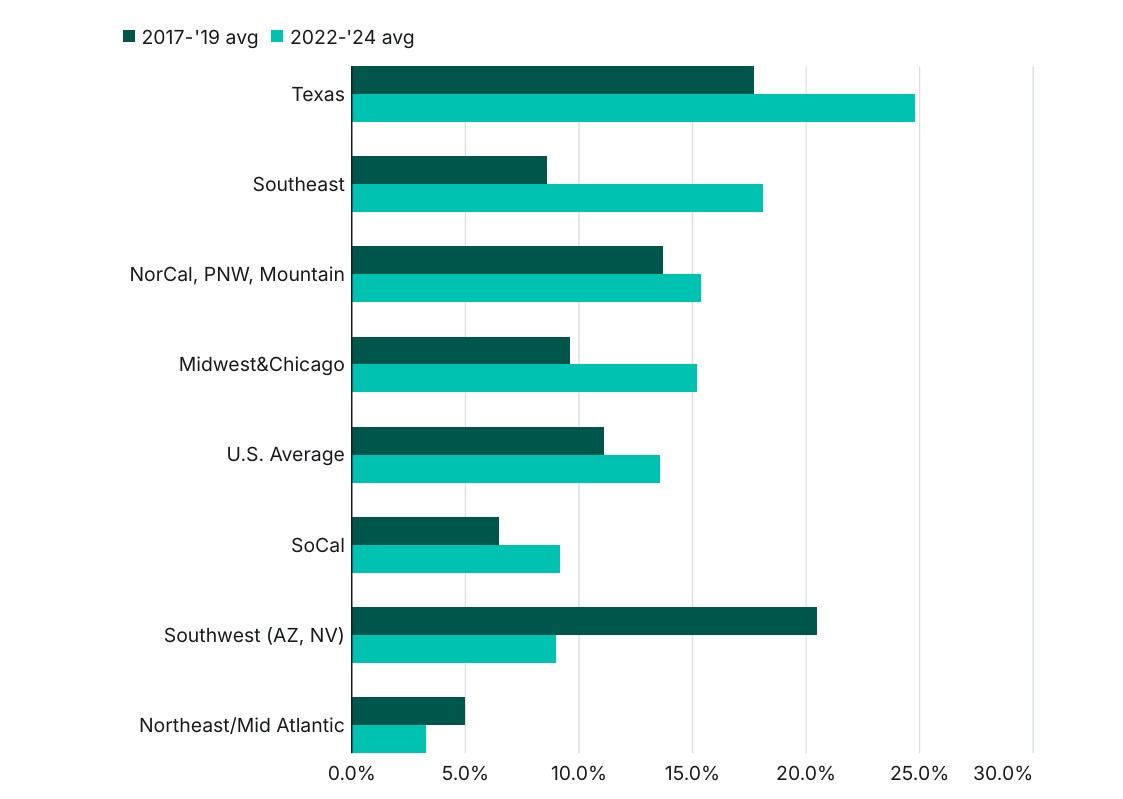

The adoption of warehouse leasing as an integral part of manufacturing planning is on the rise. The following chart illustrates manufacturing activity as a percentage of total leasing activities across major regions in the United States. This was from a study conducted by Prologis research2, a leading logistics real estate company.

The underlying data from the chart shows the increase in manufacturing as a percentage of total leasing activities between the period 2017-19 and 2022-24. Delving deeper, regions in Texas,Southeast, Northern California, Pacific North West,Mountain, Midwest & Chicago and Southern California have shown an increase in manufacturing as a percentage of total leasing activities while it has decreased only for a couple of regions in Southwest and Northeast/Mid Atlantic. This trend tells that manufacturers will continue to lease warehouse spaces for their manufacturing activities.

Warehouse management and Logistics Real Estate

The presence of warehouses can support production and productivity. These warehouses require many acres of land. The land and warehouse construction is typically managed by businesses who are into Logistics Real Estate (LRE) management. These businesses purchase land, build warehouses and lease/rent the space to businesses which strive for optimum inventory storage. LRE businesses construct speculative warehouses too meaning they foresee growth and make investments for warehouse construction and management.

The growth of LRE to support manufacturing depends on both the logistics real estate sector and manufacturing sector. Understanding the pain points of manufacturers at nearby locations paves the way to strategize and plan for the selection of land and construction of build-to-suit warehouses with proper utilization of space and design controls. These warehouses are constructed with appropriate shelf design for storage. They are equipped with controls to maintain the required temperature and any other vital parameters for storing the inventory. Leasing/renting such warehouse facilities helps manufacturers to focus on production activities and further enables them with the ability to plan production schedules.

The US Logistics Real Estate market coming under the commercial real estate market is huge and growing.3 The US Commercial real estate market is humongous and is worth about $16 trillion and manages retail real estate and industrial real estate. Logistics real estate, one of the sectors under Industrial real estate, serves retail, e-commerce and manufacturing sectors. The LRE sector is dominated by major commercial real estate firms such as JLL, Cushman Wakefield, CBRE, Colliers International, Prologis, Ambrose Property Group. Apart from these major players, there are several small to mid size real estate firms focusing on this market segment. In Plainfield IN where I live currently, HSA commercial real estate headquartered in Chicago owns 3.6 million square feet of space of industrial real estate. Prologis owns 7 warehouse properties. Plainfield has about 40 million square feet of warehouse space. Other LRE firms in Plainfield are Buske Logistics, Expeditors, Neovia Logistics, Prime Distribution services, XPO Logistics.

Robotics, Artificial Intelligence, automation and technology have the potential to play a significant role in managing materials and space in the warehouses. Advancement in these technologies in LRE will indirectly increase productivity in manufacturing. Further if new warehouses are constructed with energy efficient LEED structures, solar panels, they can support in preserving carbon footprint and sustaining the environment. Thus Logistics Real Estate when coupled with vantage locations, robust technologies, customized and sustainable construction will add immense value to growth and sustainability of manufacturing industry.

Conclusion

The growth of the manufacturing sector is perceived as a route for economic growth, self-sustainability and job creation. Integrating Artificial Intelligence is strategized as a differentiating capability in growing the sector and for staying ahead globally as a manufacturing powerhouse. Here in this blog I discussed that apart from Artificial Intelligence, the Logistics Real Estate sector will also be a crucial sector in ensuring manufacturing growth and sustainability. This sector handles the operational challenges faced by manufacturers by leasing land, constructing build-to-suit warehouses in locations closer to production centers or enroute to production centers and enabling manufacturers to handle their supply chain and inventories with cost efficiency and reliability. The role of industrial warehouses is indispensable not only in supporting the ECommerce and Retail sectors but also for the manufacturing sector and this is the period of growth for the Logistics Real Estate sector as the nation focuses on bringing back manufacturing within the borders.

Bibliography

1. Trade in Flux: What Global Shifts Mean for U.S. Logistics Real Estate, Prologis Research, April 22, 2025

2. Interpreting Implications for Logistics Real Estate, Prologis Research, June 30, 2025

3. U.S. Industrial Real Estate Market Analysis and Outlook (2025), MMCG Invest, April 2025

Image courtesy: Image by aleksandarlittlewolf on Freepik

Leave a Reply